ADVENTURE

FINANCE

How To Create A Funding Journey

That Aligns Profit With Purpose

What People Are Saying…

“Aunnie has provided founders with the playbook on how to make money work for them and their business. Adventure Finance is an accessible and engaging read for any founder. It sifts through the finance jargon and illustrates through stories, some of the real-world challenges and innovations created from implementing financial solutions in underserved communities. I hope every founder leverages this guide to fully understand their options when it comes to funding their enterprise. As Aunnie has illustrated so artfully, not all money fits every need, but when applied effectively it has the power to transform industries.”

— Ella Peinovich, Founder of Powered by People & Soko

“The world of venture funding has historically been exclusive, not inclusive. While part of the issue has to do with the make-up of venture capital firms, some of the blame lies in the industry's focus on equity funding to the exclusion of all other forms of capital investment. This needs to change. In Adventure Finance, Aunnie masterfully explores how we can broaden our view of financing and create a more inclusive financing economy. Put simply, this is the future of venture finance.”

— Seth Levine, Co-Founder of The Foundry Group

“This is a tremendous book that sets a new standard for work on impact finance. The level of technical detail - whilst never overwhelming – provides all players in the market with models and roadmaps to start or accelerate their use of impact finance. The real-world cases, from a variety of countries and sectors, are also very useful as illustrations of impact finance in practice and give meaning to the financial discussions. The book is easy to read and honest in its accounts of the good and bad, successes and failures of this emerging market. This is a must-read for anyone interested in this fascinating topic.”

— Alex Nicholls, University of Oxford’s Saïd Business School, UK

About the book

The venture capital model doesn’t work―at least not for 99% of startups and small businesses. In this 99% are a lot of companies with incredible potential: businesses headed by female founders and those from diverse racial backgrounds, organizations headquartered outside of venture capital hubs, and purpose-driven enterprises that are creating social and environmental impact alongside financial success.

Counter to what the press-savvy venture capital world would have you believe, there are a lot of funding options out there for startups and small businesses. Adventure Finance is designed to help you understand some of these options, and walk you through real examples of how other founders and funders have put them to use.

In simple, approachable language, the book breaks down the different types of funding options available from revenue-based financing to recoverable grants to redeemable equity to distributed ownership and more. Through a mix of storytelling and research-based frameworks, based on a decade of research and experience in investing in early-stage companies, this book will give you the ability to determine how each of these structures can contribute to your own funding journey.

The goal for this book is to shift the conversation about startup funding and help founders and funders widen the spectrum of “mainstream” investment options in order to make the venture financing world more inclusive and purpose-driven.

The book breaks down the different kinds of funding options available using stories from real-life founders and funders…

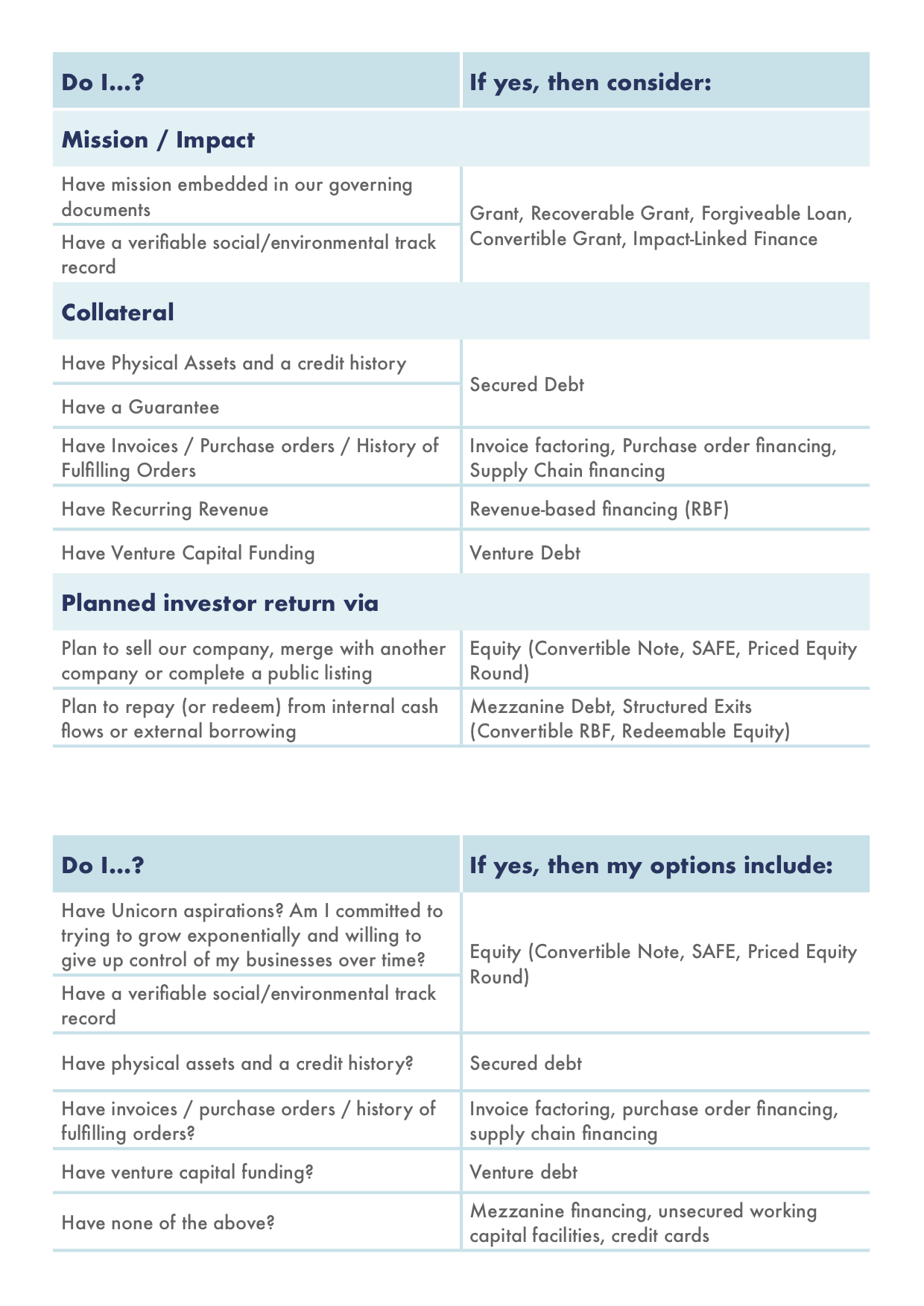

…and presents frameworks to help you evaluate your options

About Aunnie

Aunnie Patton Power is a university lecturer on Innovative Finance, Impact Investing and Technology for Impact and an advisor on these topics globally. At the University of Oxford's Saïd Business School, she holds the title Associate Fellow as well as Entrepreneur in Residence at the Skoll Centre for Social Entrepreneurship. She is also Adjunct Faculty at the University of Cape Town’s Graduate School of Business and a Visiting Fellow at the London School of Economics’ Marshall Institute for Philanthropy and Social Entrepreneurship. She also is a founding member of the Dazzle Angels, a female angel investing group. A reformed M&A investment banker, Aunnie began her impact investing career in 2010 with Unitus Capital in Bangalore and has since worked with start-ups, intermediaries, funds, family offices, foundations, corporates, and governments across Africa, Asia, Europe, and North America. Aunnie's work has been published throughout the world, including by the Oxford University Press, the Stanford Social Innovation Review, the World Economic Forum, and as Massive Open Online Courses (MOOCs) on Coursera and GetSmarter.